Soccer stadium tax breaks held over by House property tax division

Minnesota United FC is scheduled to play its home opener March 12 in TCF Bank Stadium at the University of Minnesota.

Officials for the first-year Major League Soccer team want to have future home openers occur a few miles east.

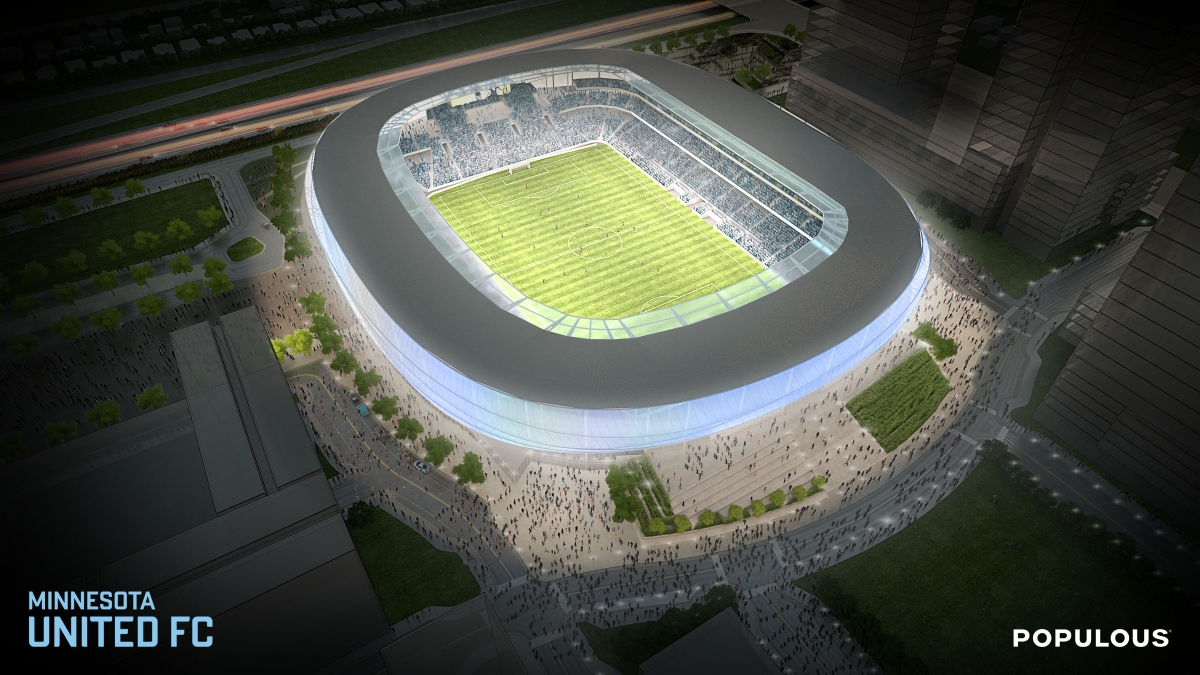

Sponsored by Rep. Joe Hoppe (R-Chaska), HF1592 would provide a sales tax construction exemption on materials used to build a proposed $150 million stadium near the intersection of Interstate 94 and Snelling Avenue in St. Paul. It would also provide a permanent property tax exemption for the site. Minnesota United FC will pay for stadium construction and operation, but the city will own the proposed 20,000-seat facility.

The sales tax construction exemption would expire one year after the first MLS game is played in the stadium.

The bill was held over Monday by the House Property Tax and Local Government Finance Division for possible inclusion in a division report that would likely become part of the omnibus tax bill. A companion, SF1255, sponsored by Sen. David Senjem (R-Rochester), awaits action by the Senate Taxes Committee.

A rendering of the future Minnesota United FC soccer stadium in St. Paul. Image courtesy Minnesota United FC

A rendering of the future Minnesota United FC soccer stadium in St. Paul. Image courtesy Minnesota United FCHoppe said the provisions were in last year’s omnibus tax bill that was vetoed by the governor because of a drafting error that could have cost the state about $100 million.

“Our project will create at least 1,900 construction jobs as well as 400-500 game-day jobs,” said Minnesota United FC President Nick Rogers. “There’s more than 77,000 Minnesotans actively participating in soccer every year. We’ve been greatly encouraged by the excitement around our project.”

Todd Hurley, finance director for the city of St. Paul, said the majority of the land is owned by the Metropolitan Council. It’s been vacant for 10 years, but city and team officials see the stadium as a catalyst for development in the area.

He added the property tax exemption would “put this stadium in alignment” with other stadiums in the state.

Rep. Diane Loeffler (DFL-Mpls) said the law enacted to help fund U.S. Bank Stadium had the property tax exemption also apply to “associated businesses, restaurants, etc… only if they’re open 200 days or less.” She said the intent was to ensure a level playing field between restaurants and other businesses within the stadium and nearby ones in the downtown area.

“The soccer stadium site is the home of a lot of existing restaurants, many of them ethnic and culturally diverse,” she said. “It would be a real disadvantage to them if the stadium design … were to incorporate restaurants and other commercial businesses that are open year round on the ground floor competing on a property tax-exempt basis with neighboring businesses that don’t have that.”

Rep. Steve Drazkowski (R-Mazeppa), the division chair, called it “a fair point.” Hoppe expressed a willingness to work with Loeffler on the issue moving forward.

Related Articles

Search Session Daily

Advanced Search OptionsPriority Dailies

Legislative leaders set 2026 committee deadlines

By Lisa Kaczke Legislative leaders on Tuesday officially set the timeline for getting bills through the committee process during the upcoming 2026 session.

Here are the three deadlines for...

Legislative leaders on Tuesday officially set the timeline for getting bills through the committee process during the upcoming 2026 session.

Here are the three deadlines for...