Tax provision making ‘zapper’ use a felony passes House

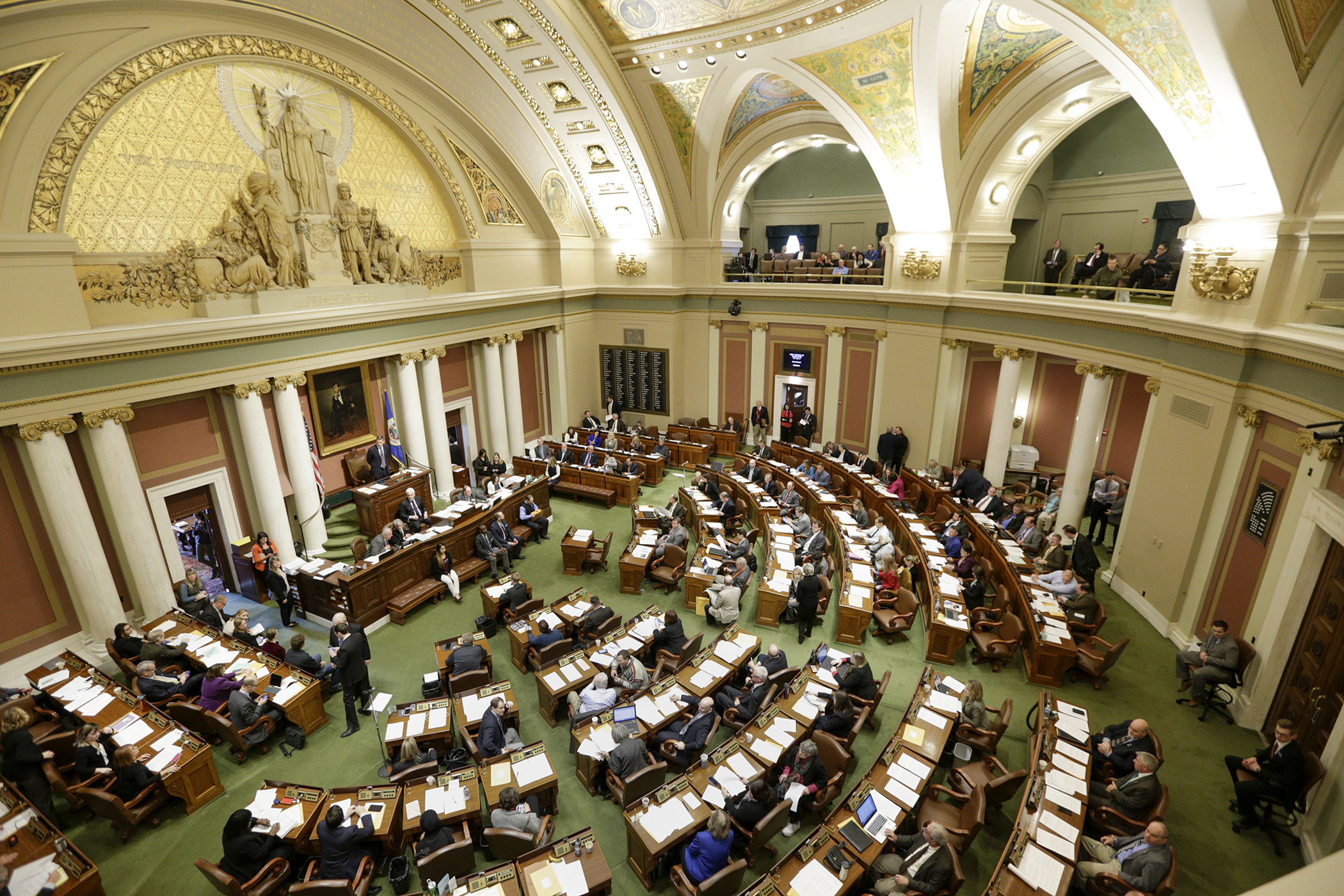

A so-called technical bill, HF1226, put forward by the Department of Revenue, was passed by the House 130-0 Thursday.

Sponsored by Rep. Greg Davids (R-Preston), the bill contains technical provisions and minor policy changes that were in last year’s vetoed tax bill and can also be found in the omnibus tax bill, HF4, currently under conference committee scrutiny.

The bill now moves to the Senate where Sen. Roger Chamberlain (R-Lino Lakes) is the sponsor.

Arguably, the most notable provision in the bill deals with so-called “zappers,” which is software installed on retail point-of-sale systems that hides certain transactions on which sales tax is collected. The bill would create a felony for someone who sells, purchases, installs, transfer, possess, accesses or uses the device. The maximum punishment would be up to five years in prison and/or a $10,000 fine.

The bill would also:

- expand electronic filing of tax return requirements by professional tax preparers to not only include personal returns, but corporate, partnership and fiduciary returns;

- change the definition of air commerce to specifically include airline companies that make three or more flights in and out of the state during a calendar year;

- clarify that all transportation pipelines are subject to assessment and taxation regardless of what is being transported through the system;

- require that partnerships file their tax returns on the same day that the equivalent federal return is due;

- clarify that taxable gifts made within three years of death are subject to estate taxes; and

- replace the term “town and farmers’ mutual insurance companies” with “township mutual insurance companies.”

Related Articles

Search Session Daily

Advanced Search OptionsPriority Dailies

Legislative leaders set 2026 committee deadlines

By Lisa Kaczke Legislative leaders on Tuesday officially set the timeline for getting bills through the committee process during the upcoming 2026 session.

Here are the three deadlines for...

Legislative leaders on Tuesday officially set the timeline for getting bills through the committee process during the upcoming 2026 session.

Here are the three deadlines for...