Walz tax proposals get first hearing in House

The “Walz Checks” are on the table.

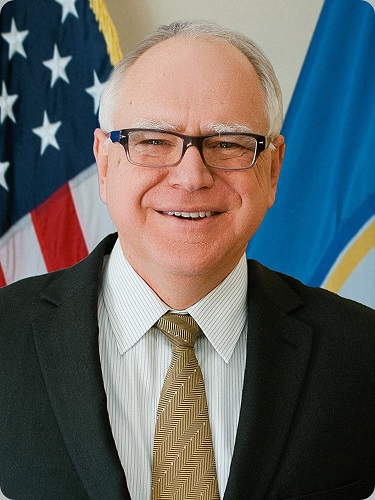

That’s a nickname given to the stimulus checks that Gov. Tim Walz’s administration would like to send out to 2.7 million Minnesota households this year. Amounting to $175 for each single filer and $350 for those married filing jointly or as heads of households, they would reduce the state’s projected budget surplus considerably.

That proposal is part of what’s been called “the governor’s tax bill,” a set of changes in state tax policy that include conforming to several federal changes, expanding the child and dependent care credit, and expanding the K-12 education credit.

The bill, HF3669, is sponsored by the House Taxes Committee chair, Rep. Paul Marquart (DFL-Dilworth). It was presented to that committee Wednesday, and laid over for possible inclusion in — or as potentially a big part of — an omnibus tax bill. It has no Senate companion.

“We have probably an $8.8 billion surplus when you count the $7.7 billion from the November forecast and the $1.15 billion from the [American Rescue Plan Act federal] funds,” Marquart said. “We have some folks who say, ‘Give it all back in tax cuts,’ and others who say, ‘Give it all back in needed investments.’ What I like about the governor’s budget is that he takes a both-and approach. He takes a balanced approach to doing both tax cuts and investing in very needed areas around the state.

“For example, if you take the unemployment insurance trust fund replenishment, which Gov. Walz proposes, and the $1 billion for the frontline workers and the $700 million for the rebate, that’s $4.4 billion, or half of the surplus, going straight back into taxpayers’ pocketbooks.”

The first item on the bill’s agenda is to pull Minnesota’s tax code into conformity with federal changes made over the past three years. And there have been many since the pandemic began, including the Families First Coronavirus Response Act, the “CARES Act,” the American Rescue Plan Act, and the Infrastructure Investment and Jobs Act. All have tax provisions that will be complicated or counteracted without the state making changes on its forms.

But much of Wednesday’s presentation by Revenue Commissioner Robert Doty, and the department’s legislative director, Joanna Bayers, was devoted to tax credits.

A lot of households would be affected by what the governor suggests for expansion of the child and dependent care credit. Among the bill provisions is a temporary increase in the maximum credit amount, which the Department of Revenue estimates would impact about 51,000 tax returns for tax year 2022, with an average reduction in tax of $161.

And the income threshold for the credit would be increased from $55,300 to $70,000. It’s estimated that 20,900 more households would thus become eligible for the credit, with an average reduction in tax of $271. It would also now be available to taxpayers regardless of marital status, which would make about 2,600 more taxpayers eligible.

An even bigger change would loom in the K-12 education credit, where the income threshold — currently at $33,500 — would increase to $70,000 and be indexed for inflation. The measure of income would be changed from “household income” to federal adjusted gross income. It’s estimated that 38,600 more households would become eligible, with an average credit amount of $300.

Other changes would involve allocating an additional $7 million for fiscal year 2023 to the “Angel” tax credit for early investors in new companies; those with an individual taxpayer identification number being able to qualify for the working family credit and homestead status; and the income threshold for senior property tax deferrals increasing from $60,000 to $75,000.

But individuals and companies wouldn’t be the only ones affected by the bill’s changes in tax law: Local governments would potentially see more money in the coffers.

For example, $100 million per fiscal year in public safety aid would be allocated to cities, counties and tribal nations with police or sheriff departments. And there would be a new sales tax exemption for building materials purchased by contractors for facilities used by local government, school districts and nonprofits.

The bill would also establish an aid program to cover the state’s portion of funding for soil and water conservation districts. And hemp would be included in the definition of an agricultural product.

So how much would all of this affect the state’s bottom line?

For fiscal year 2023, it would come out to about $1.08 billion in reduced revenue. The biggest bundle of that would come from those stimulus checks, which would amount to about $703.7 million.

But that public safety aid would also be a big chunk of it ($100 million), while exemptions for construction materials for governments and nonprofits would reduce revenue by $94.8 million. And conforming to the tax provisions in the Consolidated Appropriations Act of 2021 would mean $55.7 million less in state revenue in fiscal year 2023.

Rep. Pat Garofalo (R-Farmington) asked whether the stimulus checks would be taxable at the federal level. Doty didn’t believe so. Rep. Kristin Robbins (R-Maple Grove) inquired whether the K-12 education credit could be used for tuition. Doty said no. And Rep. Jerry Hertaus (R-Greenfield) suggested that the sales tax exemption for building materials would be very difficult to enforce and could be abused.

Rep. Michael Howard (DFL-Richfield) asked about the highest household income at which one could receive one of the stimulus checks. The answer is $273,470 for those married filing jointly.

On Thursday, the committee is scheduled to receive public testimony on the proposed tax policy changes.

Related Articles

Search Session Daily

Advanced Search OptionsPriority Dailies

Legislative leaders set 2026 committee deadlines

By Lisa Kaczke Legislative leaders on Tuesday officially set the timeline for getting bills through the committee process during the upcoming 2026 session.

Here are the three deadlines for...

Legislative leaders on Tuesday officially set the timeline for getting bills through the committee process during the upcoming 2026 session.

Here are the three deadlines for...