Closing the gap

By Nick Busse

.jpg) It’s only a first step, but House members will soon vote on a bill that would solve nearly one-third of the state’s projected $994 million budget deficit.

It’s only a first step, but House members will soon vote on a bill that would solve nearly one-third of the state’s projected $994 million budget deficit.

As early as March 22, the House could vote on

HF1671. Sponsored by Rep. Lyndon Carlson Sr. (DFL-Crystal), the bill would cut the deficit by $312 million. It’s the first of what will likely be three budget-balancing bills this session.

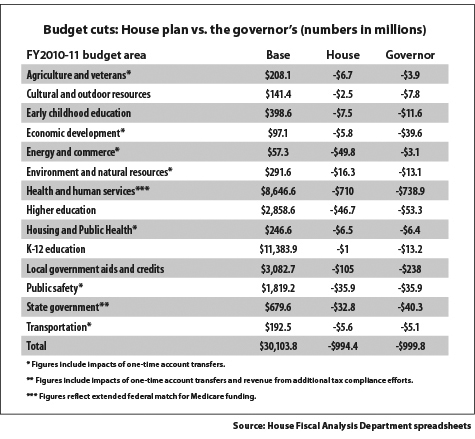

In all, the bill would cut nearly $214 million in state spending. Among the largest cuts would be reductions to local aids and credits ($105 million), higher education ($47 million), public safety ($22 million) and environment and natural resources ($13 million). The bill also includes $98 million in mostly one-time account transfers to shore up the state’s General Fund.

“I would describe it as a first major step toward balancing the budget,” Carlson said.

By and large, the proposed cuts are similar to those put forth by Gov. Tim Pawlenty in his supplemental budget plan. The bill represents a deliberate effort by the House’s DFL majority to find areas of agreement and compromise with the governor.

“It’s a bill that is loaded with some very difficult decisions as we move forward, but we were able to — from the positive side — moderate some of the governor’s recommendations,” Carlson said.

The bill represents the combined work of nine House finance divisions and the House Taxes Committee. In less than a week, 10 different bills were merged and finally approved March 17 by the House Ways and Means Committee.

The speed at which it was put together does not reflect lawmakers’ enthusiasm for the bill, however. Many lawmakers expressed misgivings about the potential impact of piling another round of budget cuts on top of last year’s cuts and unallotments.

Moreover, as difficult as this round of cutting might be, the next steps could be even harder.

House DFL leaders plan to bring two more supplemental budget bills forward this session: one for K-12 education and another for health and human services. Those bills are currently in limbo, as lawmakers await the outcome of a lawsuit that threatens to overturn the governor’s unallotment of $2.7 billion in state spending last year. Moreover, a potential windfall in the form of expanded federal Medicare funding is currently being debated in Congress, throwing another roadblock — albeit a potentially fortuitous one — into lawmakers’ budget planning.

For now, in any case, the $312 million supplemental budget bill before the House is giving members plenty to chew over.

Too much or not enough?

Too much or not enough?

At the March 12 hearing of the House Finance Committee, the mood in the room was subdued, almost somber, as committee members voted to combine nine finance bills that together would subtract $207 million from the deficit.

Presenting his share of the cuts to the committee, Rep. Tom Rukavina (DFL-Virginia) tried to break up the gloom with a little levity.

“Mr. Chair, I cut exactly like you told me to, Mr. Chair. I didn’t want to but I did it,” Rukavina said, smirking.

“I’m not sure if I should say thank you or not,” replied Carlson, the committee chairman.

Kidding aside, Rukavina expressed regret about cuts to the state’s higher education budget. His bill originally included a temporary income tax surcharge that would have raised $43 million to shore up student financial aid. Concerned about inviting a veto from the governor, House DFL leaders urged him to drop the tax increase, and he did. Still, Rukavina said it would have been the right thing to do.

“I had a little tax increase in this bill. And Mr. Chair, you convinced me I was wrong, but I don’t think I was,” Rukavina said. Chin propped up on his hand, he added, “I’m not too proud of the cuts we keep making.”

Others voiced stronger criticism. Rep. Bobby Joe Champion (DFL-Mpls) said he wasn’t sure whether he could support the bill. He pointed to a particular student financial aid cut that he said would harm those people who needed the most support. To that, Rep. Paul Thissen (DFL-Mpls) commented, “Just wait until you see the health and human services bill.”

By far, the largest cuts in

HF1671 are to cities and county aid programs. At a March 16 House Taxes Committee hearing, DFL committee members lamented the cuts and the hardship they will bring to local governments — and potentially, property taxpayers.

“I want to underline again, this is not a happy day. This is not something people generally want to do,” said Committee Chairwoman Rep. Ann Lenczewski (DFL-Bloomington).

While DFLers grapple with the costs and consequences of winning the governor’s support for their budget bill, Republicans see a different set of problems.

For the most part, the DFL’s budget plan does not include provisions to ratify Pawlenty’s unallotments. Republican members argue that failure to do so will lead to a much bigger deficit in the next biennium.

At the tax committee hearing, Rep. Paul Kohls (R-Victoria) said the DFL’s plan to cut local aids and credits by only $105 million is not realistic. He said the state will probably end up having to cut more next year, forcing cities and counties to scramble, yet again, to figure out the impact on their budgets.

“I do have a concern in that I think we are continuing at least a large degree of uncertainty for local units of government by not continuing Gov. Pawlenty’s unallotments,” Kohls said.

Differing philosophies regarding the proper role of government have also loomed large. Echoing Kohls’ comments, Rep. Laura Brod (R-New Prague) said local governments could do more with the funding they have if the state would eliminate costly mandates to cities and counties.

“I wish that flexibility was part of this discussion, because I think the discussion is more than just about money; I think the discussion is about how we position the relationship between the state and the local governments,” Brod said.

Rep. Keith Downey (R-Edina) went so far as to say the reductions are a good thing, because they will force local governments to scale back on bloated government services and be more accountable to their constituents.

“I like the fact that as we start to reduce these aids and credits, local units of government will be much more transparently accountable to their taxpayers for what’s going on locally,” he said.

Lenczewski, the tax chair, said she hopes the reductions carried in

HF1671 will be the only cuts to local government aids and credits this year. Answering many of the Republican criticisms, she said the current round of cuts will be painful enough as they are.

“We absolutely cannot deny that our actions are affecting what they’re doing,” Lenczewski said. “I think it’s just not fair to not say that this bill isn’t going to make things more difficult for folks out there.”

Session Weekly More...

Related Stories

A done deal

Budget fix makes the best of bad times for the state

(view full story)

Published 6/1/2010

Deal or no deal?

Endgame is unclear as budget talks enter final days

(view full story)

Published 5/13/2010

Unallotment undone

Court decision throws governor, lawmakers a curveball

(view full story)

Published 5/6/2010

Budget cuts, round one

Despite deep spending cuts, legislators try to soften the blow

(view full story)

Published 4/8/2010

Closing the gap

Piece by painful piece, lawmakers begin chipping away at the budget deficit

(view full story)

Published 3/18/2010

A cloudy forecast

State’s new economic projection shows more trouble on the horizon

(view full story)

Published 3/4/2010

Budget battle begins

DFL lawmakers say governor’s budget plan is incomplete, call for ‘Plan B’

(view full story)

Published 2/18/2010

Minnesota Index: The state budget

Figures and statistics on Minnesota's state budget

(view full story)

Published 2/18/2010

Cash flow conundrum

Projected cash shortages will require delicate balancing act

(view full story)

Published 2/11/2010

First Reading: From worse to bad

Stimulus helps, but lawmakers still face a record deficit

(view full story)

Published 3/6/2009

First Reading: 'Tough decisions'

Governor proposes spending cuts, accounting shifts to solve $4.8 billion deficit

(view full story)

Published 1/30/2009

At Issue: Been there, done that

House finance chair, former governor reflect on previous budget problem

(view full story)

Published 1/30/2009

At Issue: Not enough money in the cookie jar

Spending to outpace revenues as state’s population ages, report finds

(view full story)

Published 1/16/2009

First Reading: Deep in the red

Members begin session with multi-billion dollar deficit to overcome

(view full story)

Published 1/9/2009

At Issue: Starting from zero

Lawmakers consider a new approach to building the state budget

(view full story)

Published 1/9/2009