House passes paid family and medical leave bill

Boon or bane?

The paid family and medical leave bill is one or the other, depending on who’s opining about it.

Rep. Ruth Richardson (DFL-Mendota Heights) sponsors HF2 to establish a state-run insurance program that would provide Minnesota workers up to 18 weeks leave of paid leave each year for family or medical purposes.

Calling it a boon for the state, she said the bill would reduce the workforce shortage by making it easier for people to take jobs knowing they would have the flexibility to take time off for family or medical issues.

“Paid leave is one of the top three policies people prioritize when considering a state for relocation,” she said.

Republicans say it would be a bane for small employers who wouldn’t have enough employees on staff or be able to quickly hire new workers to cover the duties of employees taking paid leave. They also dislike new taxes the bill would place on employers and employees.

Rep. Ruth Richardson introduces HF2, a bill she sponsors that proposes to create a statewide family and medical benefit insurance program. (Photo by Catherine Davis)

Rep. Ruth Richardson introduces HF2, a bill she sponsors that proposes to create a statewide family and medical benefit insurance program. (Photo by Catherine Davis)The House passed the bill, as amended, 68-64 Tuesday night. The bill now goes to the Senate.

A matter of ‘our universal humanity’

“At the heart of this bill is a recognition of our universal humanity,” Richardson said. “A recognition that at some point, we or our loved ones are going to need time to bond, to heal, recover, or navigate providing care for a loved one with a serious health condition.”

She successfully offered an amendment to permit an additional six weeks of pregnancy leave above the 18-week maximum if there are complications with the pregnancy.

Richardson said this “long-overdue safety net” is needed because current leave programs are inconsistent and there are racial and socioeconomic disparities among those who have or do not have access to leave.

“Our current system design reinforces the notion that only some people are worthy of care; only some people are worthy of time off to rest, or to recover, or to care for their families,” Richardson said. “This bill will reject that harmful narrative and begin to build a long overdue and a much more inclusive safety net.”

It’s ironic, she said, that high-income people working for large corporations who can better manage a financial crisis are more likely to have employer-paid leave plans, while low-income people who may be one paycheck away from financial devastation do not.

Leave benefits would be unattached to a specific job or employer, which Richardson said would be particularly helpful to self-employed or gig workers, who could opt into the program.

Benefits would be available starting July 1, 2025.

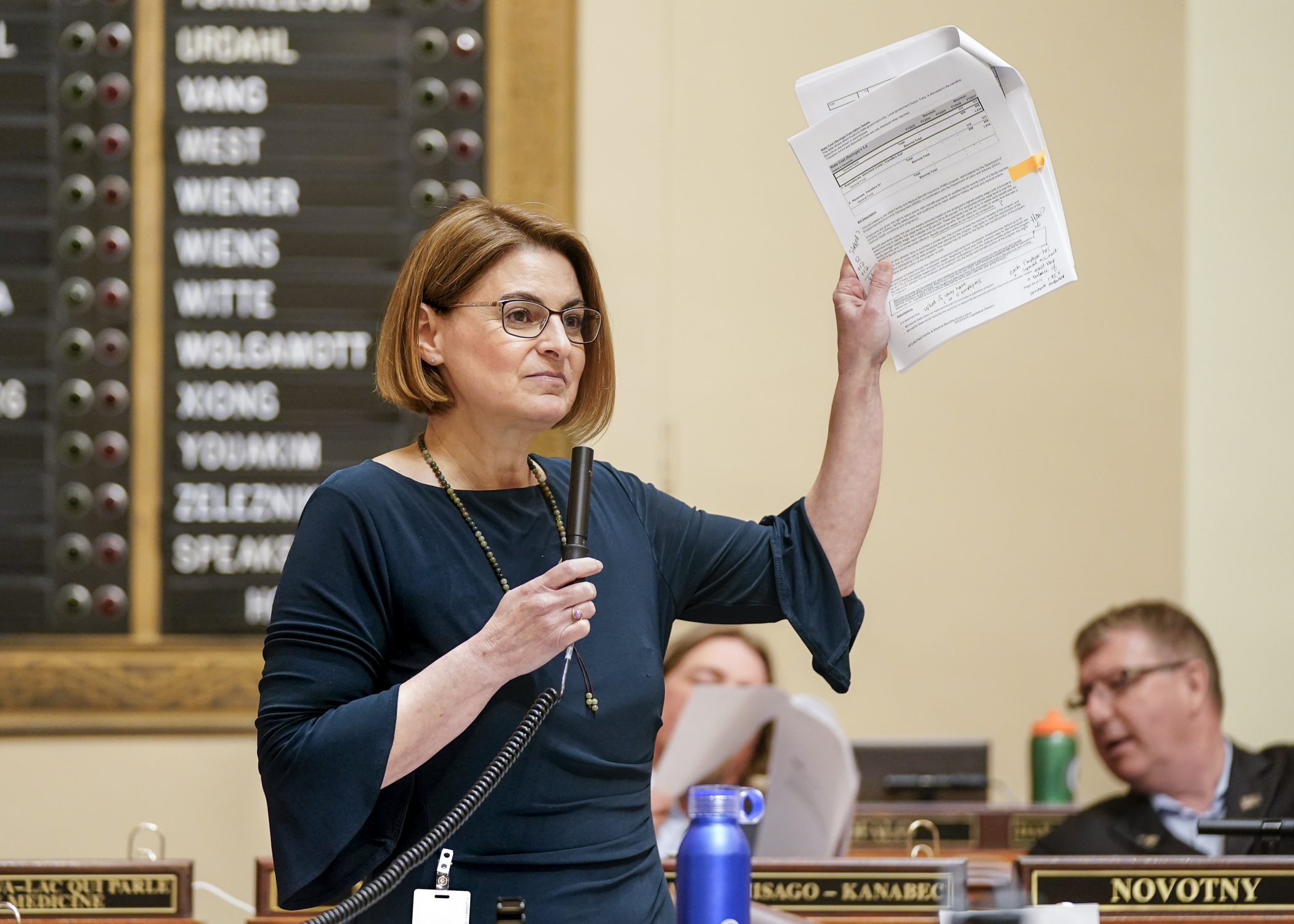

Rep. Marion O'Neill holds up the fiscal note for HF2, a bill to create a statewide family and medical benefit insurance program, during debate on the House Floor. (Photo by Catherine Davis)

Rep. Marion O'Neill holds up the fiscal note for HF2, a bill to create a statewide family and medical benefit insurance program, during debate on the House Floor. (Photo by Catherine Davis)An amendment successfully offered by Rep. Harry Niska (R-Ramsey) would require anyone fraudulently obtaining benefits to be reported to the local county attorney for prosecution.

During the many hours of debate on the bill, Republicans returned often to two themes: A state-run “one-size-fits all” leave program is especially burdensome to small businesses, and that it should be optional.

“House File 2 is a mess,” said Rep. Danny Nadeau (R-Rogers). “There’s too many unknowns. We don’t know what the impacts are, we don’t totally know what the costs are. And if we’re trying to target a population that’s underserved, I would suggest we do the hard work and create a program that serves that population rather than instituting a mandate across every business in this state that’s going to cripple them.”

What’s in the bill?

Benefits would be available to an employee unable to work due to a family member’s serious health condition, a qualifying exigency, safety leave, bonding leave, or the employee’s own pregnancy, pregnancy recovery, or serious health condition.

A self-funding family and medical insurance benefit account modeled after the state’s unemployment insurance fund would be created.

A $668.3 million allocation in seed money is called for in fiscal year 2024 before money collected via a new tax on employers and employees would fund the family and medical benefit insurance account to be overseen by a new Family and Medical Benefits Insurance Division within the Department of Employment and Economic Development.

Supporters of paid medical leave rally in front of the House Chamber May 2 before House Floor debate on HF2. (Photo by Andrew VonBank)

Supporters of paid medical leave rally in front of the House Chamber May 2 before House Floor debate on HF2. (Photo by Andrew VonBank)Employers would be allowed to institute private plans and not be required to pay premiums into the state program. However, private plans would need to meet or exceed all the same rights, protections, and benefits provided to employees under the state plan.

Republican counteroffer rejected

Rep. Dave Baker (R-Willmar) unsuccessfully offered a delete-all amendment to substitute a Republican plan that would not mandate employers to offer a leave plan, but would let them voluntarily participate in a plan offering the same leave benefits that state employees currently have.

Baker said small businesses would be incentivized to participate in the plan through tax credits. The private sector would operate the program, not state government.

“HF2 mandates a new payroll tax that will impact everyone earning a paycheck in Minnesota and the massive government agency it creates is not something that Minnesotans are asking for,” Baker said in a statement.

Richardson said the amendment is modeled after New Hampshire’s paid leave program, which she said has higher premiums and offers fewer benefits to employees.

Other Republican objections were laid out in five unsuccessfully offered amendments that would:

- exempt employers with fewer than 50 employees from being required to participate in the state paid leave program;

- delay implementation of the paid leave program until the state completes an actuarial analysis to determine if it can be sufficiently self-funding;

- limit the annual premium rate to 1% of taxable wages paid to each employee;

- exempt employers from participating in the state plan if they have private plans with 67% of the rights, protections, and benefits provided to employees under the state plan; and

- limit benefits to a maximum of 12 weeks per year.

Related Articles

Search Session Daily

Advanced Search OptionsPriority Dailies

Legislative leaders set 2026 committee deadlines

By Lisa Kaczke Legislative leaders on Tuesday officially set the timeline for getting bills through the committee process during the upcoming 2026 session.

Here are the three deadlines for...

Legislative leaders on Tuesday officially set the timeline for getting bills through the committee process during the upcoming 2026 session.

Here are the three deadlines for...

Latest budget forecast projects nearly $2.5 billion surplus, but red ink down the road

By Mike Cook Three weeks before Christmas, state budget officials provided some merriment to Minnesotans. However, Grinch-like transformations lurk.

Released Thursday, the November ...

Three weeks before Christmas, state budget officials provided some merriment to Minnesotans. However, Grinch-like transformations lurk.

Released Thursday, the November ...