Dear Friends,

The House majority has now approved all of its budget bills, and conference committees have begun. Conference committees are made up of a small number of House and Senate members (almost entirely majority members) who are tasked with finding a compromise on bills that have been approved by both the House and Senate but are not identical. Eventually, these committees will craft final bills that will be sent back to both bodies for a vote. After that occurs, those bills that pass will be sent to the governor for his signature.

Last week I commented on one of these House bills, the judiciary/public safety finance omnibus bill, in my update. Because of space, I was unable to address one of the more controversial proposals contained in this plan. I will do so below. This highly concerning provision, if passed, will very likely have a chilling effect on your First Amendment freedoms.

SHOULD STATE GOVERNMENT ‘THOUGHT POLICE’ KEEP TABS ON YOUR CONVERSATIONS AND SOCIAL MEDIA POSTS?

A hugely troubling component in the judiciary/public safety finance omnibus bill that the House majority passed last week is an attack on the first amendment rights of Minnesotans with a “thought police” provision.

Under this House Democrat plan, the Minnesota Department of Human Rights would send employees into communities to solicit “bias incidences” and collect data on individual speech that is not criminal but believed by someone to be biased and concerning.

In other words, if someone is offended by something you said and believed it was biased, they could then claim your speech was biased and would legitimately be able to report you to a state agency which could then keep that file on record.

Specifically, it forms policies to solicit, receive and compile reports from community organizations, school districts and individuals regarding incidents a community member believes are motivated by bias. That data will be stored and analyzed and could be sought after by the state – an actual government bias registry.

To give you an idea of the sorts of things that people could consider “biased,” I’ll share with you what was discussed on the House floor. A question was asked of the bill author if a written article claiming or arguing that COVID-19 is a Chinese bio-weapon that leaked from a lab in Wuhan should be put in the bias registry. The answer was it can be considered a hate or bias incident.

The bill author was then asked if someone wearing an “I love J.K. Rowling” shirt could also be put on the bias registry, and she stated that circumstance would be something for lawyers to decide.

Think about that for a minute. Giving lawyers the opportunity to determine your intent for simply wearing a shirt that someone didn’t like.

Again, this isn’t about speech that was made in relation to a hate crime or violent activity. This references non-criminal conversations or writings that someone perceives to be biased and voluntarily reports to state government because they didn’t like it.

Many of us have sarcastically referenced “Big Brother is watching you” over the years, but my goodness how can anyone see this as anything other than an attempt to stifle your First Amendment rights? Share the wrong view and the wrong person hears or reads it, then face the threat of being reported and put on the government’s bias registry.

There is no room in this country for hate speech. That said, the State of Minnesota should also not be in the business of policing your freedom to speak freely and keeping tabs on your musings that do not have violent or criminal undertones.

DFL TAX BILL PASSES IN THE HOUSE

In the midst of a more than $17.5 million historic budget surplus (an overpayment by taxpayers), how can anyone defend increasing taxes on Minnesotans? I don’t see a defense for this! Yet, the House DFL budget bills spend away almost the entire surplus (with a 40% increase to Minnesota’s government budget) and increase our taxes by $9.5 BILLION DOLLARS. The tax omnibus bill garners a $2.2 billion share in this increase.

There are some good provisions in the tax bill. Among those are a number of good property tax relief provisions, increases to the homestead credit, and expansion of the K-12 education and student loan credit. However, the harmful in this bill far outweighs the good in my opinion.

Many of you have asked me about the refund checks you’ve heard promised by the Governor and others. In this proposal is a one-time refundable credit payment effective retroactively for tax year 2021. A married joint filer earning up to $150,000 would receive a payment of $550 and all other filers earning up to $75,000 would receive a payment of $275. Households with dependents would receive an additional $275 per dependent for up to three dependents ($825).

Some of the very harmful items in this bill: this tax plan creates a 5th income tax tier. This would make Minnesota the state with the highest tax rate in the country—above even California. The bill raises taxes on business too, putting Minnesota at a huge competitive disadvantage. This proposal provides no middle-class tax relief, picks winners and losers, and focuses most of the “tax relief” to Minnesotans with no tax liability.

The bill would also allow undocumented individuals to claim a number of tax credits; spends $4.95 million in tax credits for Hollywood film producers (more money than was originally allocated for our in-crises nursing homes!); and out of the blue (never heard in committee) gives the City of St. Paul $30 million for “street improvements.” Now, I love our Capitol city, but why should they get a special carve out for something that all of our cities need? That doesn’t seem right!

This tax proposal also breaks the promise to eliminate the tax on Social Security benefits for all Minnesota seniors. This bill does raise the threshold that would allow more seniors to avoid taxation but does not eliminate this tax.

An additional harm involves our local charities. It makes adjustments to electronic pull tab regulations that will impact the revenue that is sent to local nonprofits, youth sports associations, volunteer fire departments, veterans’ groups, and other charities who benefit from charitable gambling.

I voted no on this tax bill, and am hoping for a better one when it comes back from conference committee.

THIS FAMILY AND MEDICAL LEAVE PLAN IS A RECIPE FOR DISASTER

HF 2 was passed off the House floor on Tuesday with a fully partisan vote. This Democrat crafted bill establishes a mandated government-administered Family and Medical Benefits Insurance Program. It would require Minnesota employers to join this state-run program and provide employees with 18 weeks of paid family and medical leave per year, even if employers already offer a paid leave program their employees like.

This mandate applies to virtually every employer in the state with one or more employees (part or full time), including private businesses, nonprofits, schools, and government employers. Employers would be required to retain the same job, pay, and benefits open for the employee’s return or risk hefty fines.

To administer the program, a new and expensive government agency would be created, staffed by approximately 400 new full-time government employees. The plan states that the program and insurance product would be funded with new payroll taxes on employers and employees, along with $1.7 billion in startup money from the budget surplus. The payroll tax would start at .07% but can be increased in order to fund the program. There is no payroll tax cap set in law.

It is highly concerning that no one can tell us how much this program is projected to cost. A fiscal note will not be available until July and actuarial studies have not been completed. The legislature will literally have to pass this bill into law in order to find out what it will cost Minnesotans and businesses.

I have no doubt my DFL colleagues have good intentions with plan, but this bill is a recipe for disaster on many fronts – and not just in the budget arena.

Think of all our local businesses have been through over the past three years: locked down during the pandemic, high inflationary operational costs, employee shortages, additional regulations – and now a new and expensive mandatory paid family leave program. They can’t take much more. Minnesota is starting to lose businesses like California is.

There are lots of questions. What happens to businesses that care for people like nursing homes, hospitals, and childcare centers when too many employees are on leave? Do they send elderly parents back home for a time to live with their families? Do hospitals turn away patients for lack of nurses and doctors? What about our schools? Sorry, we don’t have enough teachers for the next six weeks so your child will need to stay home and we’ll have to go remote?

These types of service businesses are already experiencing huge employee shortages – not to mention all businesses. Where do employers find the temp employees (and the money to pay them) to come in for 6, 12, or 18 weeks when they already can’t find enough employees?

Our businesses will not survive this. Our schools and local governments cannot afford this unfunded mandate. Our state will continue to lose employers and the jobs that go with them. Family and medical leave won’t mean a thing if one doesn’t have a job in the first place. I voted no on this bill.

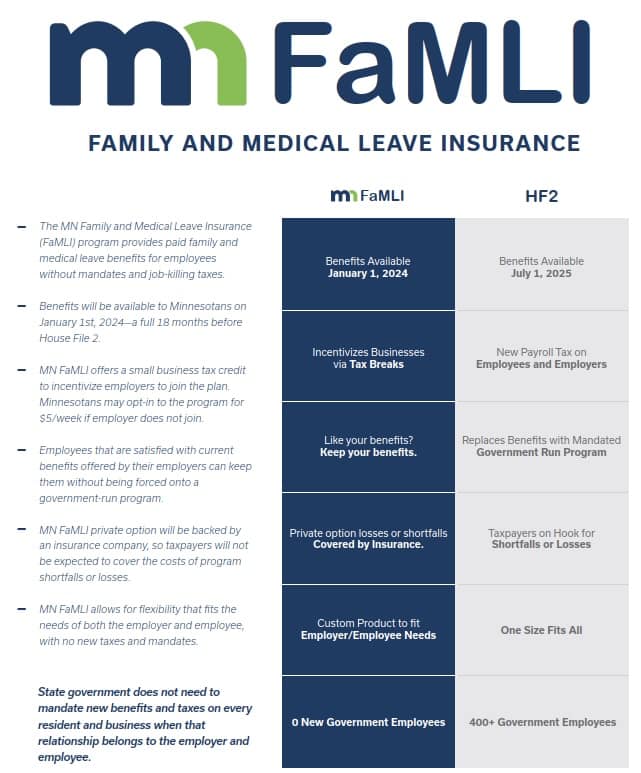

I recognize that this is an important issue. My Republican colleagues and I offered an alternative option which would provide a balanced, compassionate, and realistic approach to make sure that every family in our state has access to paid family and medical leave. This plan accomplishes the job without mandates, new payroll taxes, and creating huge new government bureaucracies, and it had bipartisan support.

People want more choices – not more government. Please see the graphic below to compare the Republican plan and HF2. Unfortunately, our proposal was voted down by the majority and the Democrat plan was adopted.

LOCAL PASTOR OPENS HOUSE IN PRAYER

It was a joy to have Pastor Ryan Quigley and his son, Elijah, come visit at the Capitol on Thursday. Pastor Ryan, of the Albert Lea Assembly of God Church, opened our House session with an awesome and powerful prayer.

Elijah takes part in a statewide youth government organization, so he was quite familiar with the place and knew his way around pretty well. I love to see our young people show interest in their government! It was great to see both Elijah and Pastor Ryan here. Thank you for the wonderful prayer, Pastor Ryan!

Have a good weekend,

Peggy