Dear neighbors,

I hope everyone is enjoying the nice spring weather! We’re still hard at work at the State Capitol as we vote on policy bills on the House Floor aimed at improving the lives of working and middle class Minnesotans.

Here’s a look at what we’ve been up to recently:

Haverhill Township Clean Up

This week, I presented a bill to the House Environment Committee to appropriate $800,000 to help clean up a tax-forfeited property in Haverhill Township. Olmsted County acquired a rural property in Haverhill Township in 2017 through the state tax forfeiture process. The property had previously been used by the U.S. Air Force as a radar station before being turned into a farm in the 1960s. This bill sheds light on a problem experienced by counties across the state. Costs to clean up tax-forfeited parcels are frequently higher than revenues the land sales will generate and there are few options to access support for these remediation efforts.

House File 3425 would appropriate $800,000 to the Pollution Control Agency to remediate petroleum tanks leftover from the Air Force, remove approximately 80,000 old tires, demolish buildings, and remove remaining asbestos to ensure the lands will be safe and productive for the future. Thank you to Olmsted County Commissioner Mark Thein and Haverhill Township Supervisor John Johnson for joining me in the hearing.

Town Hall

Thank you to everyone who joined Rep. Andy Smith, Rep. Tina Liebling, Sen. Liz Boldon, and I at our Rochester-area town hall last weekend! It was great hearing from our constituents about the issues you care about most.

Tax Season Reminder

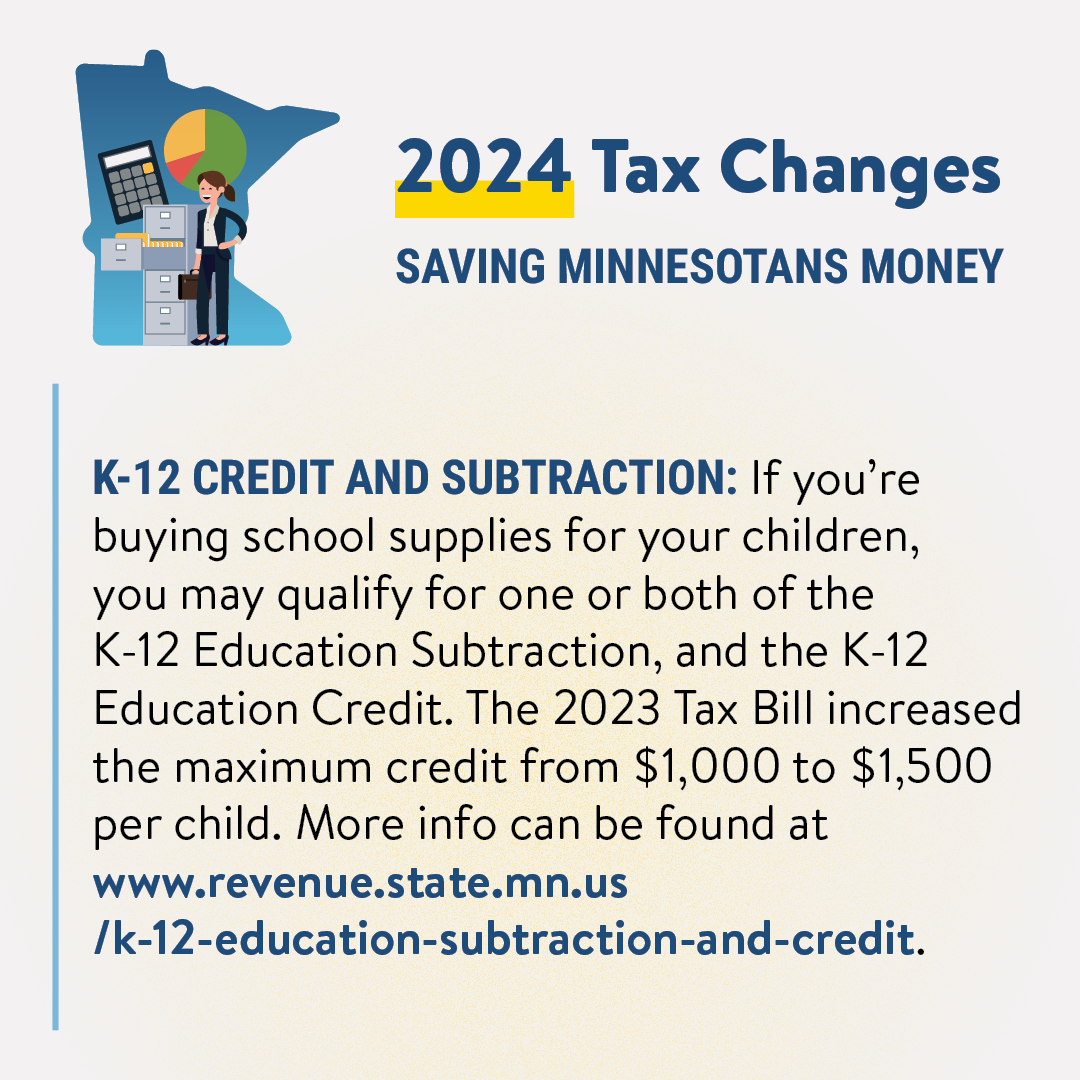

Tax Day is this Monday, April 15! As a reminder, if you’re a renter, don't forget to claim your property tax refund! This is the first year renters will be able to receive this credit with their tax filing rather than later in the year. Along with making it simpler and more convenient, we also expanded the credit to many Minnesotans who didn’t qualify previously.

I also want to remind you that nearly 300,000 Minnesota households are eligible for the nation-leading Child Tax Credit! With our Child Tax Credit, families will save up to $1,750 for each dependent. Democrats are cutting child poverty by one-third with this rebate.

You can claim the tax credit by filing a 2023 income tax return. The $1,750 credit is for each child 17 years old and younger, with no limit on the number of children. For all tax filers, this credit begins to phase out at an income level of $35,000 and fully phases out at a maximum of $90,750 for a family with four children.

Minnesota families: If you qualify, file your taxes to make sure you claim the benefits available to you.

Stay Connected with the Legislature

Please continue to reach out with any input, ideas, or feedback about the issues important to you. I value hearing from you, so call or email any time. You can find my information on my House website. You can also like my Facebook page, and follow me on Twitter.

It is an honor to represent you at the State Capitol.

Sincerely,

Kim Hicks

State Representative