Dear neighbor,

We’ve had a productive start to the year, and we plan to keep the momentum going as we work to build economic opportunities for families and communities.

Here’s the latest from the State Capitol:

Debt Fairness Act

Medical debt is the leading cause of bankruptcy in the country– that’s why DFLers have introduced the Minnesota Debt Fairness Act. Too many people are saddled with unmanageable debt, and our current laws have been insufficient at addressing this dilemma. Medical debt depletes peoples’ rainy-day funds, causes them to incur credit card debt, and forgo medical treatment altogether. The Debt Fairness Act aims to unburden Minnesotans from medical debt, and help working and middle class families make ends meet.

EMT Training/Paramedic Scholarships Available

DFLers are working to address the Emergency Medical Services (EMS) statewide shortage. One of these initiatives, that I supported, funds a one-time appropriation of $3 million for up to 600 scholarships of $5,000 starting Fall 2024 to be awarded by June 30, 2026. If you or anyone you know might be interested in this opportunity to serve the public and give back to the community, you can find eligibility information here.

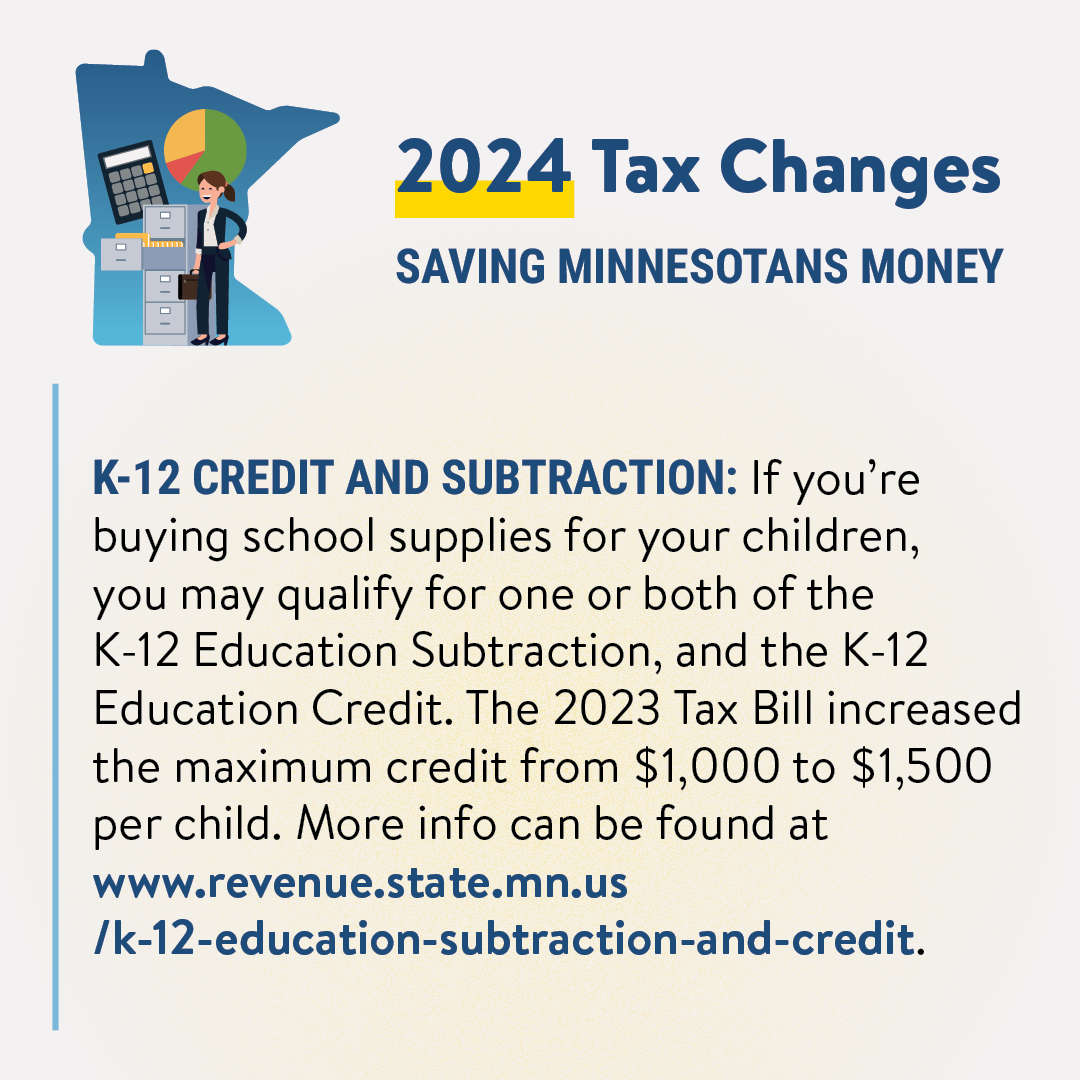

Tax Season Update

DFLers have been making big moves to help working families, and you’ll feel some of the benefits this year when you file your 2023 taxes. During the first week of the 2024 legislative session, the House passed a technical corrections bill for the 2023 Tax Bill. This was our very first action on the floor this year because it will affect nearly all Minnesotans as we prepare to file taxes. This bill ensures all Minnesotans receive the return for which they’re entitled. The biggest change from last year’s bill was updating how we account for inflation, and the adjustment will save Minnesotans around $300 million dollars as they file 2023 taxes.

If you’re a renter, don't forget to claim your property tax refund. This is the first year renters will be able to receive this credit with their tax filing rather than later in the year. Along with making it simpler and more convenient, we also expanded the credit to many Minnesotans who didn’t qualify previously.

I also want to remind you that nearly 300,000 Minnesota households are eligible for the nation-leading Child Tax Credit. With our Child Tax Credit, families will save up to $1,750 for each dependent. Democrats are cutting child poverty by one-third with this rebate.

You can claim the tax credit by filing a 2023 income tax return. The $1,750 credit is for each child 17 years old and younger, with no limit on the number of children. For all tax filers, this credit begins to phase out at an income level of $35,000 and fully phases out at a maximum of $90,750 for a family with four children.

Minnesota families: If you qualify, file your taxes to make sure you claim the benefits available to you.

Stay Connected!

Unfortunately, due to technological constraints, replies to this newsletter won’t reach my email account. To share your input or ideas, or if I can ever be of assistance, please feel free to reach out at rep.ned.carroll@house.mn.gov or 651-296-5510, and I will be happy to help.

Warmly,

Ned Carroll,

State Representative