Graphs

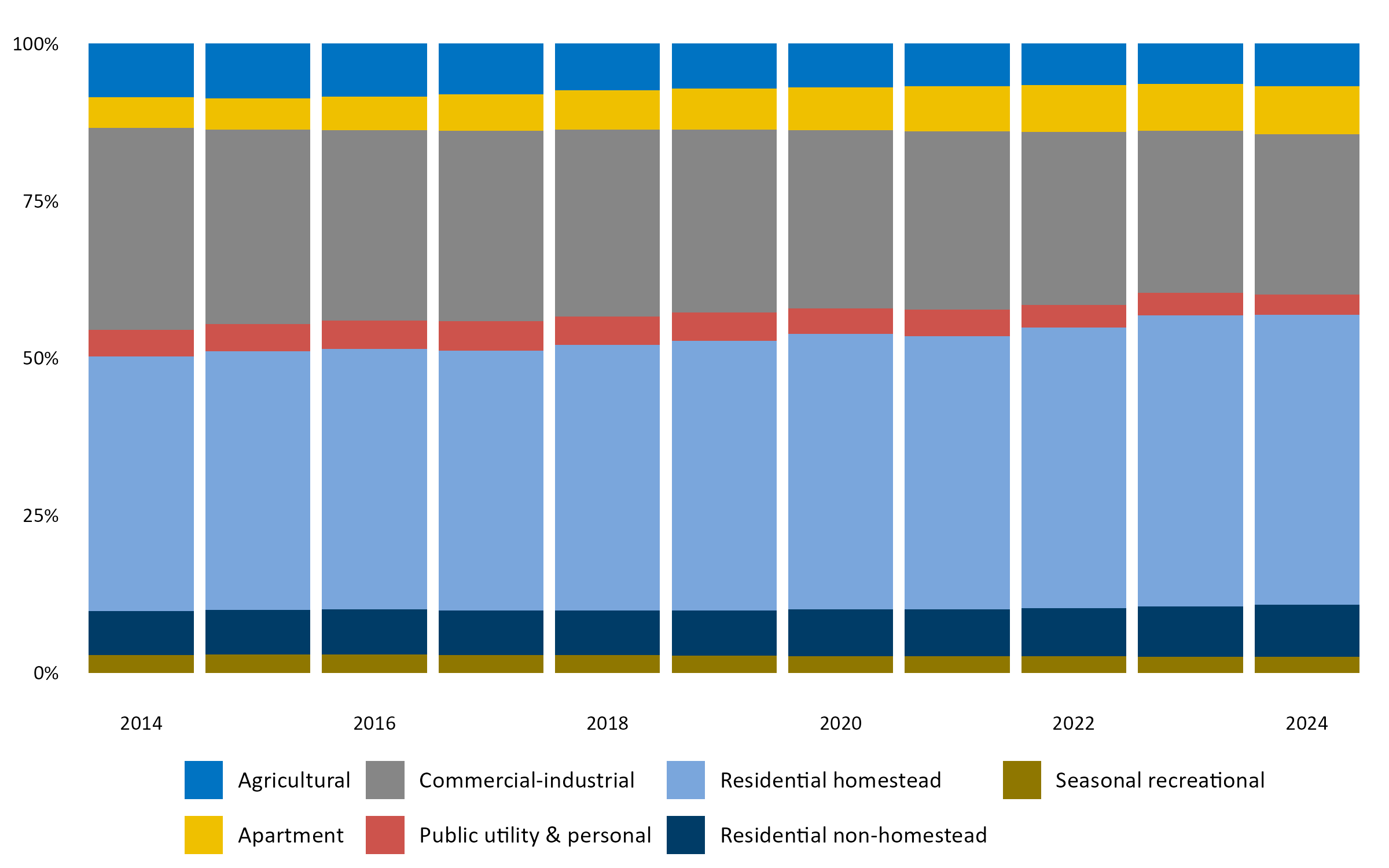

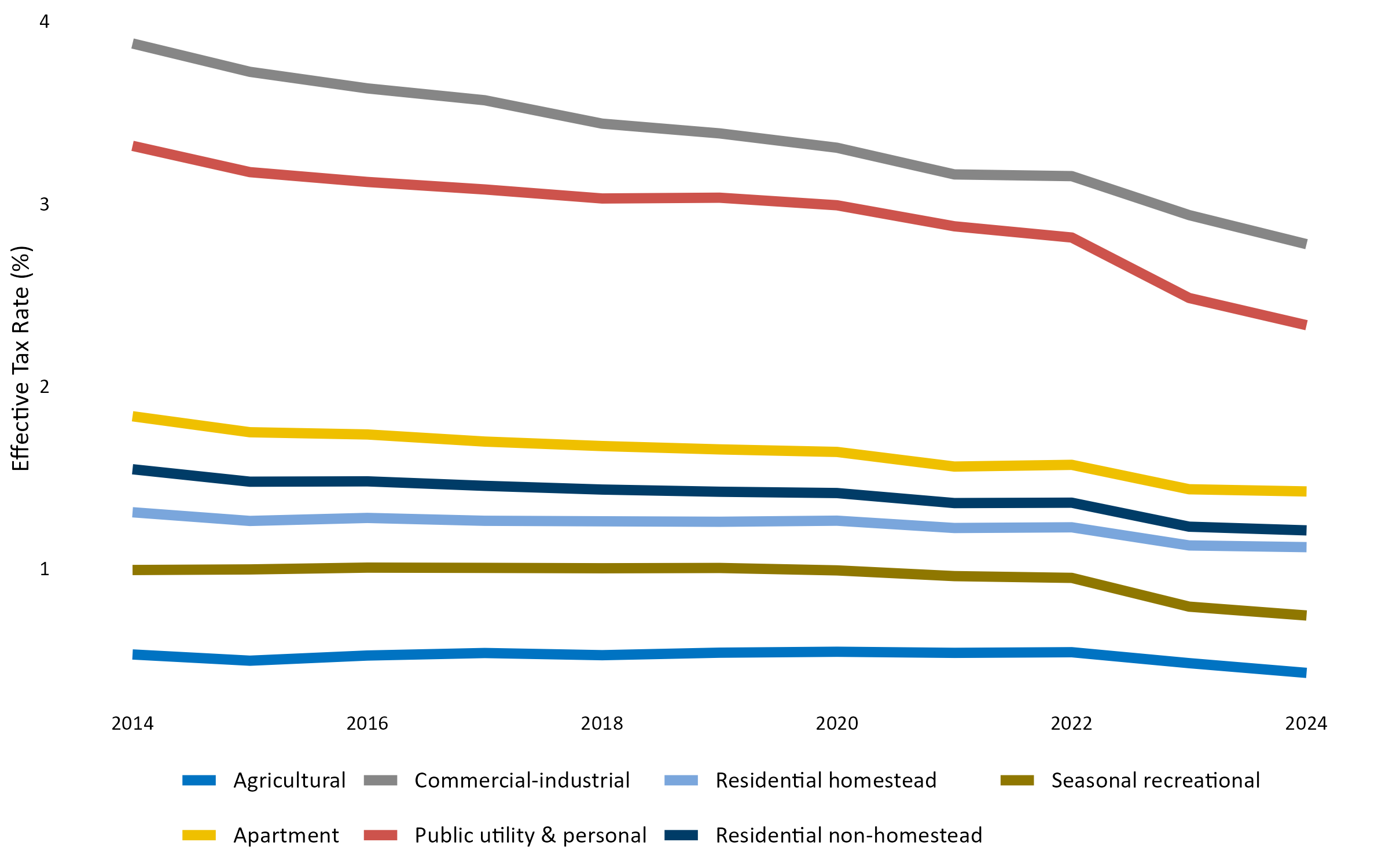

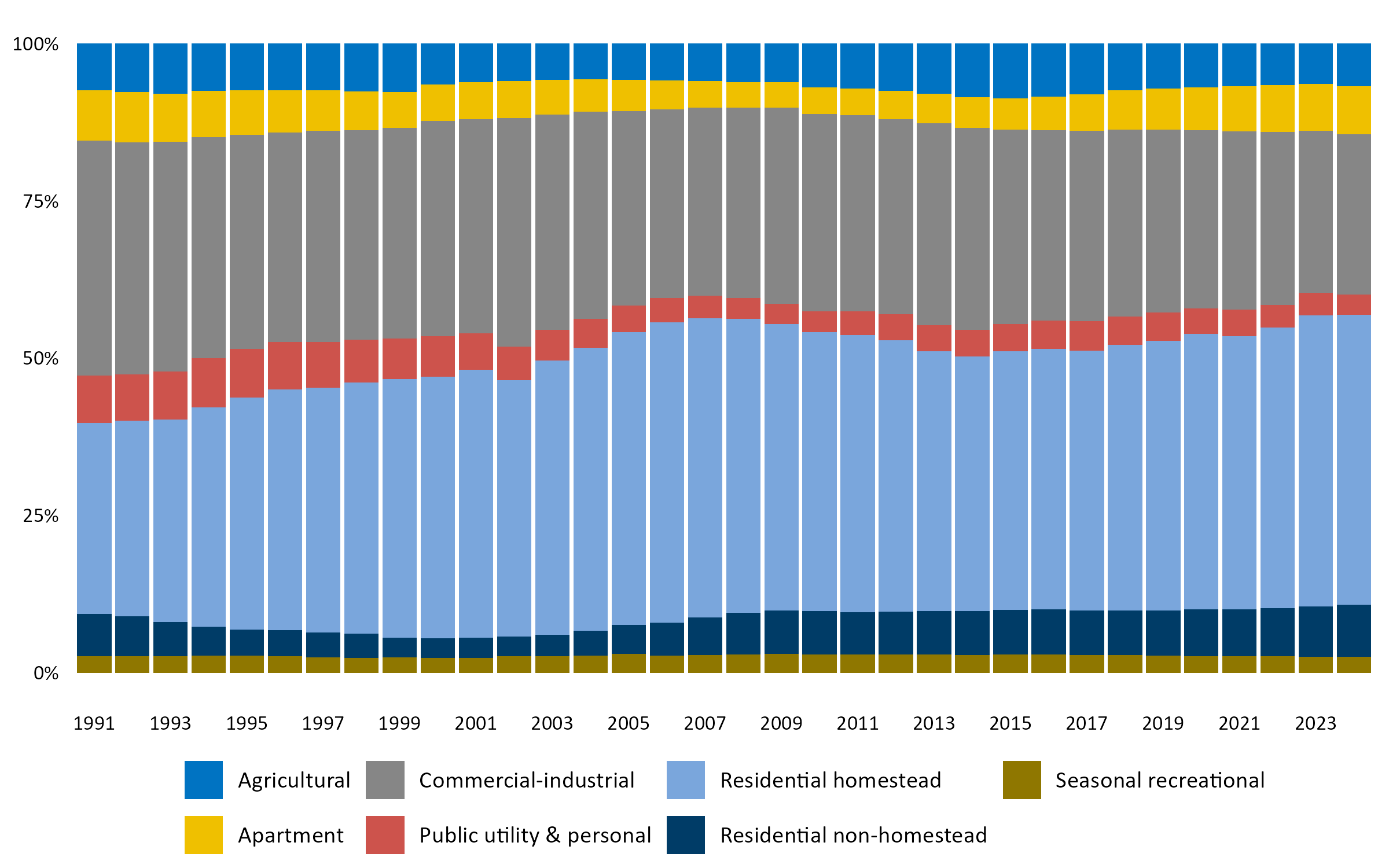

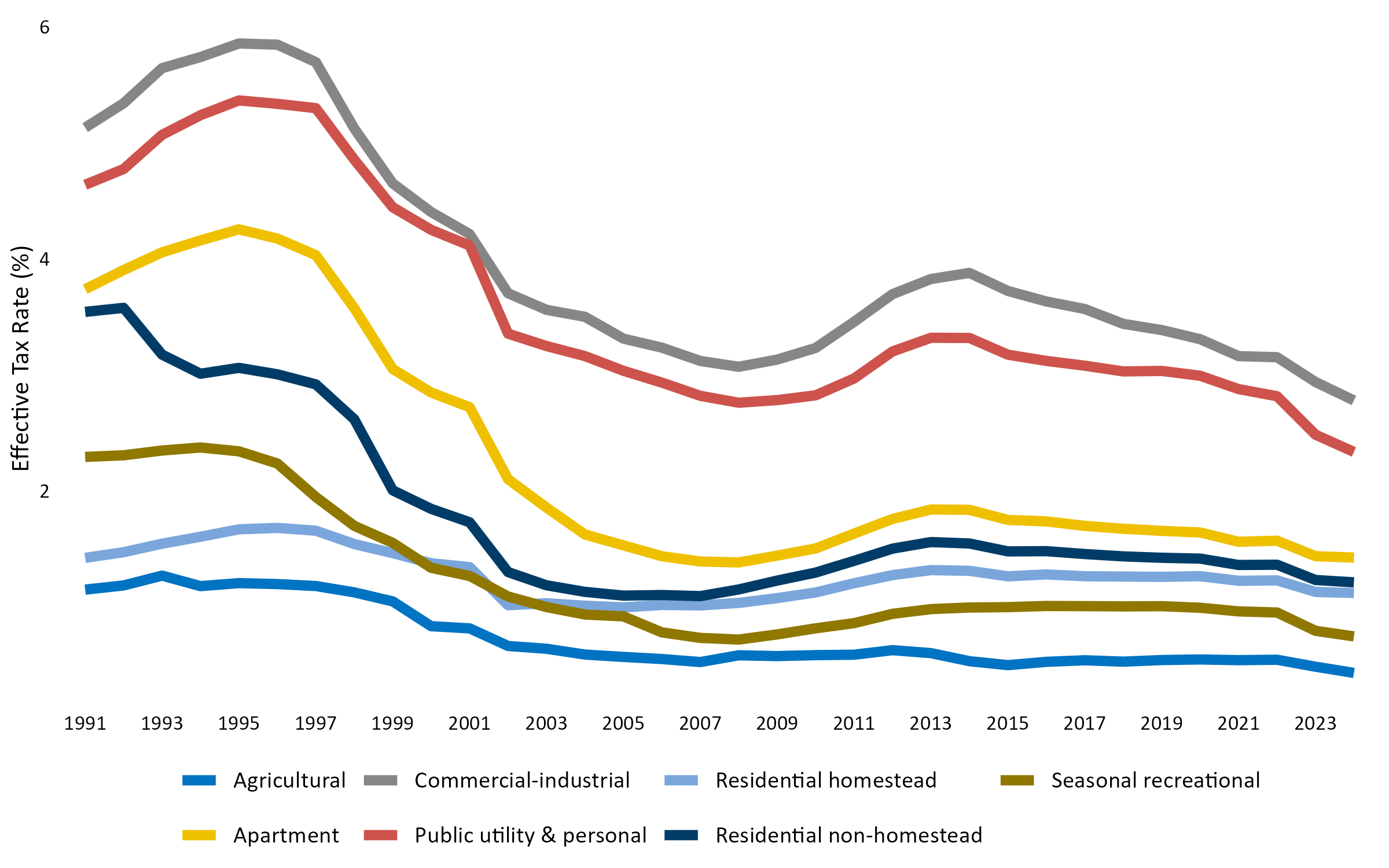

The graphs below show statewide changes in property tax burdens by property

type over time, resulting from both changes in law and differences in market

value growth rates between the various types of property. The first

and third graphs show each property type's share of the total property tax

burden. The second and fourth graphs show how each property

type's tax burden has changed relative to its market value (the relationship

between a type of property's net tax and its market value is called its

"effective tax rate").

The first two graphs focus on the last ten years, while the next two show the same

relationship over a longer period of time.

Statewide Shares of Net Tax by Property Type, 2014-2024

Statewide Effective Tax Rates by Property Type, 2014-2024

Statewide Effective Tax Rates by Property Type, 1991-2024

Statewide Shares of Net Tax by Property Type, 1991-2024

Related information

Data Sources

Data in the graphs comes from actual property tax data reported by counties to the Minnesota Department of Revenue.

Definitions

"Residential homestead" property means all property classified by the assessor as

residential (nonfarm) homestead.

"Residential nonhomestead" means residential rental properties consisting of one to

three dwelling units, along with vacant land that is zoned residential.

"Seasonal-recreational" property means both commercial and noncommercial

recreational property, and includes the "qualifying golf course" and "metro indoor recreational" classes.

"Agricultural" property includes agricultural land and buildings, including the house,

garage, and one-acre portion of each homesteaded farm, and also includes property classified as timberland.

"Apartment" property means residential rental properties of four or more units, and

includes some miscellaneous residential property types such as manufactured home parks,

nonprofit community services property, and student housing.

"Commercial-industrial" property means all properties placed in any

commercial-industrial classification by the assessor, and includes railroad property and mineral property.

"Public utility" property means all property placed in any public utility classification

by the assessor, and also includes all personal property (including the personal property classes

that are unrelated to public utilities).

Note that the value of manufactured housing is not included in any of the categories, because

that property type is not included in the data from the Minnesota Department of Revenue and is generally taxed somewhat differently.

November 2024